Discovering the Perks and Risks of Purchasing Cryptocurrencies

The landscape of copyright financial investment is identified by an intricate interaction of compelling benefits and substantial dangers. As we further examine the subtleties of copyright investment, it becomes noticeable that educated decision-making is vital; however, the inquiry stays: How can capitalists successfully balance these advantages and dangers to secure their monetary futures?

Comprehending copyright Basics

As the electronic landscape progresses, comprehending the basics of copyright comes to be important for potential capitalists. copyright is a form of electronic or online currency that utilizes cryptography for safety and security, making it hard to fake or double-spend. The decentralized nature of cryptocurrencies, generally improved blockchain technology, boosts their safety and openness, as deals are recorded across a dispersed ledger.

Bitcoin, developed in 2009, is the first and most popular copyright, but hundreds of alternatives, recognized as altcoins, have emerged ever since, each with special functions and objectives. Investors must familiarize themselves with key principles, including budgets, which store personal and public tricks necessary for deals, and exchanges, where cryptocurrencies can be acquired, sold, or traded.

Furthermore, recognizing the volatility related to copyright markets is vital, as prices can vary dramatically within short periods. Regulative factors to consider additionally play a significant function, as various nations have differing positions on copyright, impacting its use and acceptance. By comprehending these fundamental components, prospective investors can make informed decisions as they navigate the complicated globe of cryptocurrencies.

Trick Advantages of copyright Financial Investment

Purchasing cryptocurrencies offers several compelling advantages that can attract both beginner and knowledgeable financiers alike. Among the main advantages is the capacity for considerable returns. Historically, cryptocurrencies have actually displayed exceptional rate admiration, with very early adopters of possessions like Bitcoin and Ethereum recognizing considerable gains.

One more secret advantage is the diversification opportunity that cryptocurrencies provide. As a non-correlated asset class, cryptocurrencies can act as a bush versus standard market volatility, enabling capitalists to spread their threats throughout different investment cars. This diversification can boost total profile performance.

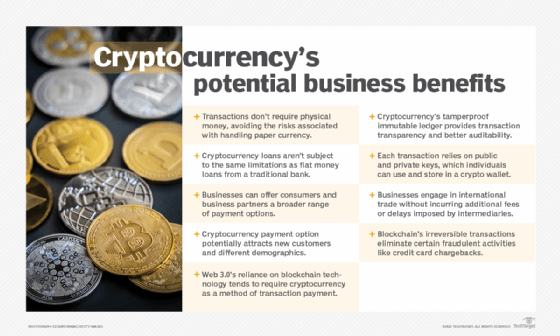

Furthermore, the decentralized nature of cryptocurrencies offers a degree of freedom and control over one's possessions that is typically lacking in conventional finance. Capitalists can handle their holdings without intermediaries, potentially reducing costs and boosting transparency.

Additionally, the growing acceptance of cryptocurrencies in mainstream finance and commerce better strengthens their value proposal. Numerous businesses now approve copyright settlements, leading the way for broader fostering.

Lastly, the technical advancement underlying cryptocurrencies, such as blockchain, presents opportunities for financial investment in emerging fields, consisting of decentralized finance (DeFi) and non-fungible symbols (NFTs), enriching the financial investment landscape.

Major Dangers to Consider

Another essential risk is governing uncertainty. Governments around the globe are still formulating policies pertaining to cryptocurrencies, and modifications in laws can drastically influence market dynamics - order cryptocurrencies. An undesirable governing environment could restrict trading or perhaps lead to the banning of specific cryptocurrencies

Protection click this risks also present a substantial threat. Unlike conventional monetary systems, cryptocurrencies are at risk to hacking and fraud. Investor losses can happen if exchanges are hacked or if personal secrets are endangered.

Last but not least, the lack of consumer protections in the copyright space can leave financiers prone - order cryptocurrencies. With restricted choice in the occasion of fraudulence or burglary, people might locate it testing to recoup shed funds

Taking into account these threats, comprehensive research study and danger evaluation are important before participating in copyright investments.

Techniques for Successful Investing

Developing a durable method is vital for navigating the intricacies of copyright financial investment. Investors should start by carrying out comprehensive study to comprehend the underlying innovations and market characteristics of different cryptocurrencies. This includes remaining informed concerning patterns, governing advancements, and market sentiment, which can dramatically influence property performance.

Diversity is one more key method. By spreading financial investments across numerous cryptocurrencies, financiers can minimize threats connected with volatility in any solitary asset. A healthy portfolio can supply a buffer against market changes while improving the possibility for returns.

Setting clear financial investment goals is vital - order cryptocurrencies. Whether going for temporary gains or long-term riches buildup, specifying details goals assists in making educated decisions. Carrying out stop-loss orders can also safeguard financial investments from substantial recessions, permitting a self-displined exit method

Last but not least, continuous monitoring and review of the financial investment approach is vital. The copyright landscape is dynamic, and regularly assessing performance against market problems makes certain that investors remain nimble and responsive. By adhering to helpful resources these methods, investors can enhance their possibilities of success in the ever-evolving world of copyright.

Future Trends in copyright

As capitalists improve their methods, comprehending future patterns in copyright becomes significantly crucial. The landscape of digital currencies is advancing swiftly, influenced by technological innovations, governing advancements, and shifting market characteristics.

One more emerging fad is the expanding institutional interest in cryptocurrencies. As firms and banks adopt electronic currencies, mainstream approval is likely to raise, possibly resulting in better cost stability and liquidity. Furthermore, the integration of blockchain modern technology into numerous markets mean a future where cryptocurrencies work as a backbone for deals across markets.

Furthermore, the governing landscape is developing, with federal governments seeking to develop frameworks that stabilize innovation and customer defense. This regulative quality could cultivate a more secure investment setting. Lastly, innovations in scalability and energy-efficient consensus systems will certainly address worries bordering deal rate and ecological impact, making cryptocurrencies a lot more viable for day-to-day use. Understanding these patterns will certainly be crucial for investors seeking to browse the intricacies of the copyright market effectively.

Verdict